Semi monthly pay has become a popular choice among businesses, offering both benefits and challenges. This article aims to shed light on the semi-monthly pay schedule, its implications, and why companies opt for this payment method.

What is Semi-Monthly Pay?

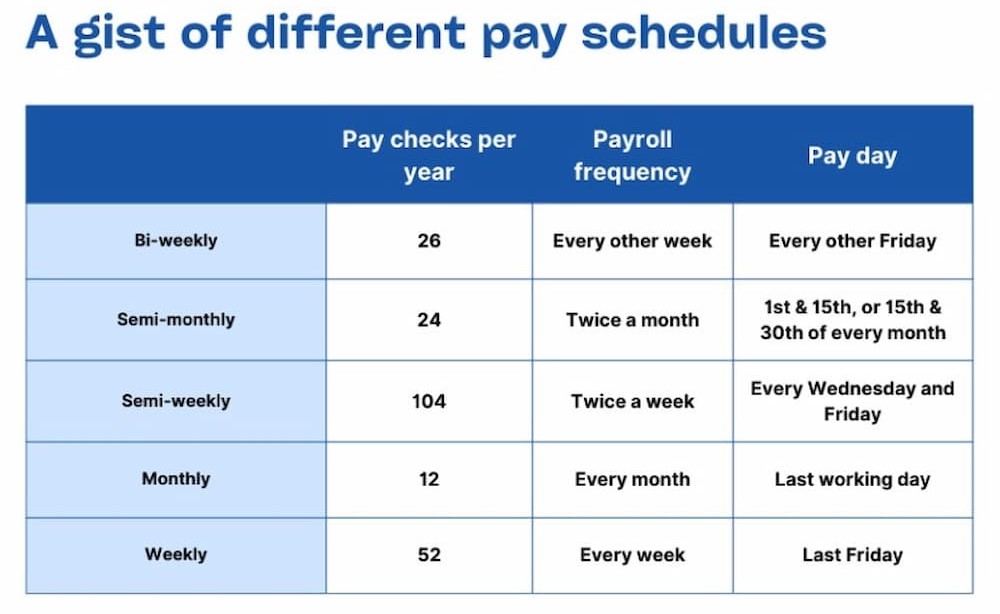

Semi-monthly pay refers to a pay schedule where employees receive their wages twice a month. This could be on the 1st and 15th, 1st and 16th, 15th and 31st, or 16th and the last day of the month. Understanding this schedule is crucial for both employers and employees to manage finances effectively.

Number of Semi-Monthly Pay Period in a Year

In a semi-monthly pay schedule, there are typically 24 pay periods in a year. This can vary slightly depending on the month and the company’s specific payroll calendar. It’s essential to be aware of this when budgeting and planning expenses.

Understanding the Semi-Monthly Pay Schedule

Common semi monthly dates include:

Semi Monthly 1st and 15th

The most traditional semi-monthly pay schedule involves paying employees on the 1st and 15th of each month. This regularity can help employees plan their finances more effectively.

Semi Monthly 1st and 16th

Another common schedule is paying on the 1st and 16th. This slight shift can sometimes be beneficial for companies to align with their financial cycles.

Semi Monthly 15th and 31st (Last Day of the Month)

Paying on the 15th and the last day of the month provides a more evenly distributed payment schedule, helping employees maintain a consistent cash flow.

Semi Monthly 16th and Last Day of the Month

This schedule is similar to the previous one but shifts the second payment by one day. It’s another option for companies looking to balance their cash flow.

Pros of Semi Monthly Pay Periods

Semi Monthly Pay Period Saves Companies Money

One of the significant advantages of semi-monthly pay is the potential cost savings for businesses. By reducing the number of pay runs, companies can save on administrative costs.

Increases Productivity

With a fixed payday, employees are often more motivated and productive, knowing exactly when they will receive their paycheck.

Better Match with Business Cycle

Semi-monthly pay can align better with a company’s business cycle, helping to manage cash flow and expenses more efficiently.

Fixed Payday for Employee

Knowing when they’ll get paid helps employees budget and plan their finances, reducing stress and uncertainty.

Reduce Waiting Period

Employees don’t have to wait as long between paychecks, helping them manage their day-to-day expenses more effectively.

Simple to Calculate

Semi-monthly pay is straightforward to calculate, making it easier for payroll departments and reducing the chance of errors.

Cons of Semi-Monthly Pay Periods

Harder to budget with semimonthly pay cycle

For some employees, managing finances on a semi-monthly pay cycle can be challenging, especially if they are used to weekly or bi-weekly paychecks.

Possible to Accidentally Overestimate Semi Monthly Pay Cycles

With two paychecks a month, there’s a risk of overestimating income, leading to financial mismanagement.

Semi Monthly Pay Periods May be Challenging for Managers

Managing payroll on a semi-monthly basis can be more complex and time-consuming for managers, especially in larger companies.

FAQs

How does a semi-monthly pay schedule work?

A semi-monthly pay schedule means employees receive their paychecks twice a month, usually on specific dates like the 1st and 15th or 15th and the last day of the month.

What are the most common semi monthly dates?

The most common semi monthly dates include the 1st and 15th, 1st and 16th, 15th and 31st, and 16th and the last day of the month.

How many pay periods are there in a semi-monthly pay schedule?

In a semi-monthly pay schedule, there are typically 24 pay periods in a year.

What are the advantages of semi monthly pay periods?

The advantages include cost savings for companies, increased productivity, better alignment with the business cycle, fixed payday for employees, reduced waiting period, and ease of calculation.

Are there any disadvantages to semi-monthly pay periods?

Yes, some disadvantages include challenges in budgeting, the risk of accidentally overestimating pay cycles, and the complexity it may introduce for managers.

How can companies overcome the challenges of semi-monthly pay periods?

Companies can overcome challenges by providing financial education to employees, implementing budgeting tools, and improving payroll management systems.

Conclusion

In conclusion, understanding and effectively managing semi-monthly pay schedules can significantly impact both employers and employees. While semi-monthly pay periods offer benefits like simplified calculations, increased productivity, and better alignment with business cycles, they also come with challenges such as budgeting difficulties and potential for overestimating pay cycles. By leveraging the insights and resources available, businesses can optimize their payroll management strategies, ensuring timely and accurate payments while fostering financial well-being for their workforce. It’s essential for organizations to stay informed, adapt to changing financial landscapes, and prioritize transparent communication to navigate the complexities associated with semi-monthly pay effectively.

For further insights into payroll management and financial planning, you may find these high-authority resources beneficial:

- Internal Revenue Service (IRS) – Understanding Payroll Taxes

- Harvard Business Review – The Future of Payroll Systems

- Forbes – Best Practices in Employee Compensation

These links provide comprehensive information on payroll systems, tax regulations, and best practices in employee compensation, offering valuable insights for both employers and employees alike.